Effective budget planning is key for businesses to manage money well. A business loan calculator is a big help. It lets businesses figure out their monthly payments based on the loan amount, interest rate, and term.

With a business loan calculator, companies can make smart borrowing choices. This tool is a must for financial planning. It helps businesses see what they owe and plan their money better.

Knowing how a business loan calculator works in financial planning is very helpful. It lets businesses try out different loan options. They can change things around to find the best loan for them.

Key Takeaways

- Business loan calculators help estimate monthly loan payments.

- They enable businesses to make informed decisions about borrowing.

- Effective use of these calculators is crucial for financial planning.

- Businesses can explore different loan scenarios and adjust variables.

- Using a business loan calculator aids in allocating resources effectively.

Understanding Business Loan Calculators

Business loan calculators are key for companies looking at financing. They help estimate what you owe and guide loan choices.

What is a Business Loan Calculator?

A business loan calculator is a digital tool. It figures out your monthly loan payments. It looks at loan amount, interest rate, and term to give a precise estimate.

Key Components of Loan Calculators

The main parts are:

- Loan Amount: The total borrowed by the business.

- Interest Rate: The percentage of interest paid on the loan.

- Term: How long to repay the loan.

These parts are key to figuring out your monthly payment.

Benefits of Using Digital Calculation Tools

Using a business loan calculator has many benefits, like:

- Accurate financial planning

- Comparing different loan options

- Making smart choices on loan terms

These tools help businesses understand their financial duties. They can plan better.

Why Business Loan Calculators Are Essential for Budget Planning

A business loan calculator is key for businesses wanting to improve their budget planning with loan calculator. It gives precise financial forecasts. This helps businesses make smart choices about their money.

Forecasting Cash Flow Accurately

Business loan calculators help predict cash flow by looking at different loans and their costs. This lets businesses know what they owe and plan better.

Avoiding Financial Surprises

Loan calculators show a clear loan repayment plan. This helps businesses manage money better and avoid cash flow problems.

Making Data-Driven Financing Decisions

With a business loan calculator, businesses can make data-driven financing decisions. They can compare loans and see how they affect their budget. This leads to better choices and the right loan for their needs.

Comparing Different Loan Options Efficiently

Businesses can quickly compare loans using calculators. They look at interest rates, repayment terms, and fees. This helps find the best loan and make smart budgeting choices.Using a business loan calculator helps businesses maximize their budget. They can reach their financial goals more easily.

Gathering the Necessary Information Before Using a Calculator

Before you start with business loan calculators, get the right info for accurate results. You need the right data to use a business loan calculator well.

Determining Your Exact Loan Amount Needs

To use a business loan calculator right, figure out how much you need to borrow. Think about what your business needs, like growing, buying equipment, or more cash. Knowing your exact loan amount helps avoid too much debt and keeps your business payments manageable.

Researching Current Market Interest Rates

Interest rates change how much you pay back. Looking up current interest rates shows the loan’s cost. Check rates from different lenders to find the best deal. This info is key for planning your budget with a business loan calculator.

Understanding Term Length Options

The loan term affects your monthly payments and total interest. Knowing about term lengths lets you pick a loan that fits your cash flow. Longer terms might lower monthly payments but raise the total interest.

Identifying Additional Fees and Costs

There are costs beyond interest rates with business loans. Knowing these extra fees gives a clear picture of your loan’s total cost.

Origination Fees

Origination fees are what lenders charge for processing your loan. These fees can be 1% to 5% of the loan amount.

Processing Fees

Processing fees cover the costs of handling your loan. These fees can differ a lot between lenders.

Early Repayment Penalties

Some loans have penalties for paying off early. It’s important to know these penalties if you think you’ll pay off your loan early.

| Fee Type | Description | Typical Range |

| Origination Fees | Charges for processing the loan | 1% – 5% |

| Processing Fees | Administrative costs for handling the loan | Varies |

| Early Repayment Penalties | Penalties for paying off the loan early | Varies |

With the right info, you can use a business loan calculator to plan your budget. This helps make smart financial choices. Being prepared helps you handle business financing better.

How to Use a Business Loan Calculator to Plan Your Budget

Business loan calculators are great tools for planning your budget. They help you make smart choices about your business money. This way, your budget fits your financial situation.

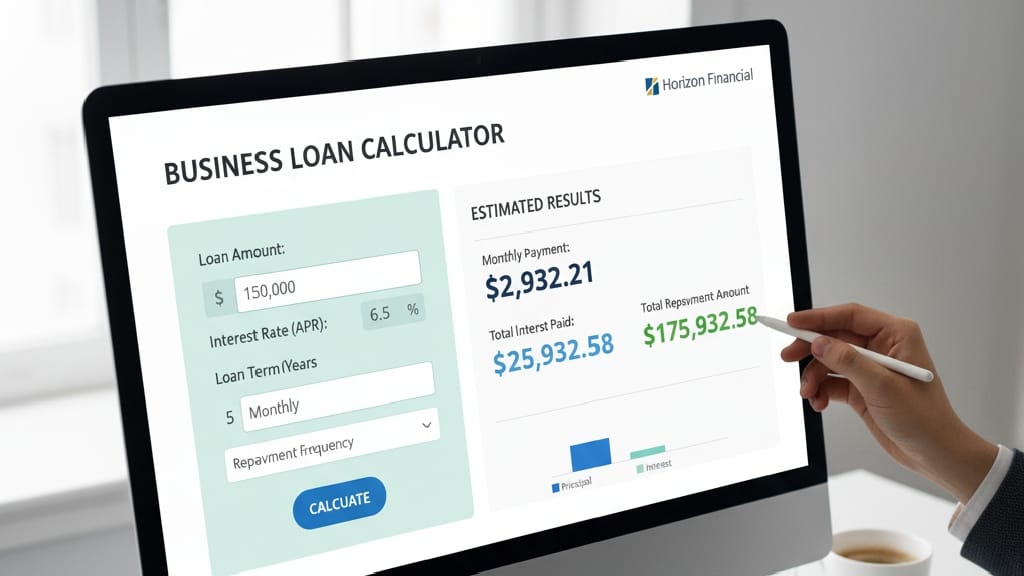

Step 1: Inputting Basic Loan Details

The first thing to do is enter your loan basics. This means the loan amount, interest rate, and how long you’ll pay it back. Getting these right is key for good calculator results.

Step 2: Adjusting Variables for Different Scenarios

Business loan calculators let you change things to see how they affect your payments. Try different interest rates, loan terms, and amounts. This shows how they change your monthly payments and total cost.

Step 3: Interpreting the Results

After you’ve put in your details and changed things around, the calculator shows you what you’ll pay. You’ll see your monthly payment, total interest, and the loan’s total cost. It’s important to understand these to plan your budget well.

Step 4: Saving and Comparing Multiple Calculations

Many calculators let you save and compare different plans. This is great for finding the best loan for your business.

| Loan Term | Interest Rate | Monthly Payment | Total Interest Paid |

| 3 Years | 6% | $304 | $1,494 |

| 5 Years | 7% | $198 | $3,950 |

| 7 Years | 8% | $157 | $6,194 |

Step 5: Integrating Results into Your Budget Spreadsheet

The last step is to add the calculator’s results to your budget spreadsheet. This means adding your monthly payments to your total expenses. This makes sure your budget is doable and realistic.

By following these steps, you can use a business loan calculator to plan your budget. This helps you make smart financial choices for your business.

Analyzing Different Loan Types with Your Calculator

Loans come in many types, each with its own way of being figured out. A loan calculator helps you see these differences. Knowing about each loan type lets you choose wisely, fitting your business needs and money situation.

Term Loans vs. Lines of Credit

Term loans give you a big sum to pay back over time. Lines of credit let you use money as you need it, up to a limit. A loan calculator shows you the cost of each choice.

Term loans are good for big, one-time buys. Lines of credit work better for ongoing costs or when money flow changes.

SBA Loans and Their Unique Calculations

SBA loans are backed by the government. They often have lower down payments and longer payback times. When using a calculator for SBA loans, remember to include the fees and lower interest rates.

Equipment Financing Considerations

Equipment financing lets you buy what you need over time. Think about how the equipment will wear down and the loan’s length when calculating.

Working Capital Loans

Working capital loans help with short-term needs. Use a calculator to look at interest rates and how flexible the repayment is. This ensures it fits your cash flow.

Commercial Real Estate Loans

Commercial real estate loans are for big amounts and long times. They often use the property as security. A calculator helps you see how the loan’s length and potential big payments affect you.

| Loan Type | Key Characteristics | Calculator Considerations |

| Term Loans | Fixed amount, fixed term | Total cost, monthly payments |

| Lines of Credit | Flexible access to funds | Interest rates, repayment terms |

| SBA Loans | Government-backed, favorable terms | Guarantee fees, interest rates |

| Equipment Financing | Equipment as collateral | Depreciation, loan term |

| Working Capital Loans | Short-term operational needs | Interest rate, repayment flexibility |

| Commercial Real Estate Loans | Long-term, property as collateral | Amortization, balloon payments |

Using a business loan calculator helps you understand different loans. This way, you can make informed decisions for your business’s health and growth. Whether it’s a term loan, line of credit, or other, a calculator is key for smart budgeting.

Incorporating Loan Payments into Your Business Budget

Planning your budget well means thinking about loan payments. This helps keep your business finances healthy. By adding loan payments to your budget, you can manage money better and grow sustainably.

Aligning Payment Schedules with Revenue Cycles

It’s key to match loan payments with when your business makes money. This way, you avoid default and keep finances stable.

To do this, businesses should:

- Look at when they make the most and least money.

- Ask to pay loans back when they have more money.

- Think about flexible plans that change with your finances.

Creating a Debt Service Coverage Ratio

A Debt Service Coverage Ratio (DSCR) shows if you can pay your loans. It’s your income minus expenses divided by your debt.

A good DSCR means you can pay your loans easily. To improve it, increase your income and manage debt well.

Building a Financial Buffer for Security

Having a financial cushion is vital. It helps with unexpected costs or less money coming in. This way, you can keep paying your loans even when things get tough.

Adjusting Other Budget Categories to Accommodate Loan Payments

To fit in loan payments, you might need to change other parts of your budget. This means deciding where to spend your money.

Operational Expenses

You might need to cut down on costs to pay your loans. This could mean making things more efficient, cutting waste, or getting better deals from suppliers.

Growth Investments

But don’t forget about growing your business. It’s important to balance paying loans and investing in growth for success.

Emergency Funds

Setting aside some money for emergencies is smart. It helps you keep paying your loans even when things go wrong.

By carefully adding loan payments to your budget and making changes as needed, you can keep your finances stable. This helps you reach your long-term goals.

Advanced Calculator Features for Comprehensive Budget Planning

Business loan calculators now have cool features. They give deep insights into loan repayment and its financial effects. These tools help businesses make smart money choices.

Understanding Amortization Schedules

An amortization schedule shows how you’ll pay back your loan. It breaks down the principal and interest over time. This lets businesses see their cash flow needs.

Using Early Repayment Calculators

Early repayment calculators let businesses see the perks of paying off loans early. This can save a lot on interest, especially for companies with changing money flow.

Exploring Tax Implication Tools

Some calculators have tools for tax implications. They show the tax benefits of loan interest payments. This is great for planning your finances.

Scenario Planning with Sensitivity Analysis

Sensitivity analysis lets businesses test different financial scenarios. It shows how changes in interest rates or repayment terms affect loans. This is key for solid financial planning.

| Feature | Description | Benefit |

| Amortization Schedule | Outlines repayment plan | Helps understand cash flow |

| Early Repayment Calculator | Explores early payoff benefits | Saves on interest costs |

| Tax Implication Tools | Assesses tax benefits | Enhances financial planning |

| Sensitivity Analysis | Models different scenarios | Prepares for financial changes |

Common Mistakes to Avoid When Using Loan Calculators

Using loan calculators right is key for good budget planning. Businesses often miss important details that affect their money health.

Overlooking Additional Fees and Costs

Many businesses forget to include all fees and costs. Loan calculators need info on origination fees, closing costs, and more. Not adding these can make loan costs seem lower than they are.

Ignoring Variable Interest Rate Possibilities

Not thinking about variable interest rates is another mistake. These rates can change with the market, changing what you pay each month. It’s important to know how rate changes might affect you.

- Underestimating Repayment Capacity: Businesses should really check if they can pay back the loan.

- Failing to Account for Seasonal Fluctuations: Businesses that change with the seasons need to think about how this affects loan payments.

- Not Considering Credit Score Impact: Your credit score can change loan terms. A better score can mean better terms.

Knowing these mistakes helps businesses use loan calculators better for budgeting.

Real-World Examples: Successful Budget Planning with Loan Calculators

Loan calculators have a big impact on business budget planning. They help businesses make smart financial choices. This leads to better budgeting.

Small Retail Business Expansion Case Study

A small retail business planned to grow. They used a loan calculator to find the best financing. This way, they could align their loan payments with their revenue cycles.

This ensured a smooth move to their new location.

Manufacturing Company Equipment Upgrade Example

A manufacturing company wanted to upgrade their equipment. They used a loan calculator to see the costs. This helped them maximize their budget by picking the best loan.

Service Business Working Capital Management

A service business needed better working capital management. They used a loan calculator to find the right financing. This helped them cover costs during slow times and keep cash flow steady.

Startup Funding Scenario Analysis

A startup analyzed their funding needs with a loan calculator. This analysis helped them budget effectively with the loan calculator. They were ready for different financial situations and made smart funding choices.

These stories show the benefits of using business loan calculators in budget planning. They give a clear view of loan repayment. This helps businesses make smart financial decisions and reach their goals.

Conclusion: Maximizing Your Financial Success with Strategic Loan Planning

Planning your business budget well is key to success. Using a business loan calculator is a big step. It helps you make smart choices about your money.

A loan calculator helps businesses predict their cash flow. It keeps surprises away and lets you compare loans easily. It shows you how much you’ll pay back and helps fit it into your budget.

Adding smart loan planning to your strategy boosts your business’s money success. It’s not just about the calculator. You also need to know about different loans and their effects on your budget.

With the right tools and knowledge, businesses can reach their money goals. Business loan calculators are powerful. They help you manage your money and lead your business to success.

Table of Contents

What is a business loan calculator, and how does it help with budget planning?

A business loan calculator is a tool for businesses. It helps estimate monthly payments. This way, businesses can plan their finances better.

What information do I need to gather before using a business loan calculator?

To use a business loan calculator, you need to know a few things. First, figure out how much money you need. Then, look up current interest rates. Also, know the term length and any extra fees.

How do I use a business loan calculator to plan my budget?

To plan your budget with a business loan calculator, start by entering basic loan details. Then, change variables to see different scenarios. Look at the results and save them. Use these results in your budget spreadsheet.

Can I use a business loan calculator to compare different loan types?

Yes, you can compare different loans with a business loan calculator. It helps you see which loan is best for your business. You can compare term loans, lines of credit, and more.

How do I incorporate loan payments into my business budget?

To add loan payments to your budget, match payments with your income. Create a debt coverage ratio. Also, save money for emergencies. Adjust other budget areas for loan payments.

What are some advanced features of business loan calculators?

Advanced features include understanding how payments are spread out. You can also use early repayment tools. There are tools for taxes and scenario planning.

What are some common mistakes to avoid when using loan calculators?

Don’t forget extra fees and variable rates. Don’t underestimate what you can pay back. Also, remember seasonal changes and credit score impacts.

Can you provide examples of businesses that have used loan calculators for successful budget planning?

Yes, many businesses have planned well with loan calculators. For example, small retail stores and manufacturing companies have expanded. Service businesses and startups have also managed their finances better.

How can I maximize my financial success with strategic loan planning using a business loan calculator?

Use a business loan calculator to make smart borrowing choices. It helps forecast your cash flow. This way, you can plan your budget better and secure your financial future.

What are the benefits of using a business loan calculator for financial planning?

Using a business loan calculator helps make better financing choices. It avoids surprises and gives a clear cash flow forecast. This leads to a more successful and stable business.